How a Legacy Media Company Dwarfed Venture Capitalists’ Returns on Reddit

The world was a much different place when media titan Condé Nast bought fledgling internet forum Reddit for around $10 million in 2006. Media companies were still figuring out the internet—Condé had just bought the website for Wired, a magazine it already owned—and glossy print titles like Vogue and an arsenal of newspapers were raking in advertising profits for Condé’s parent company, Advance Publications.

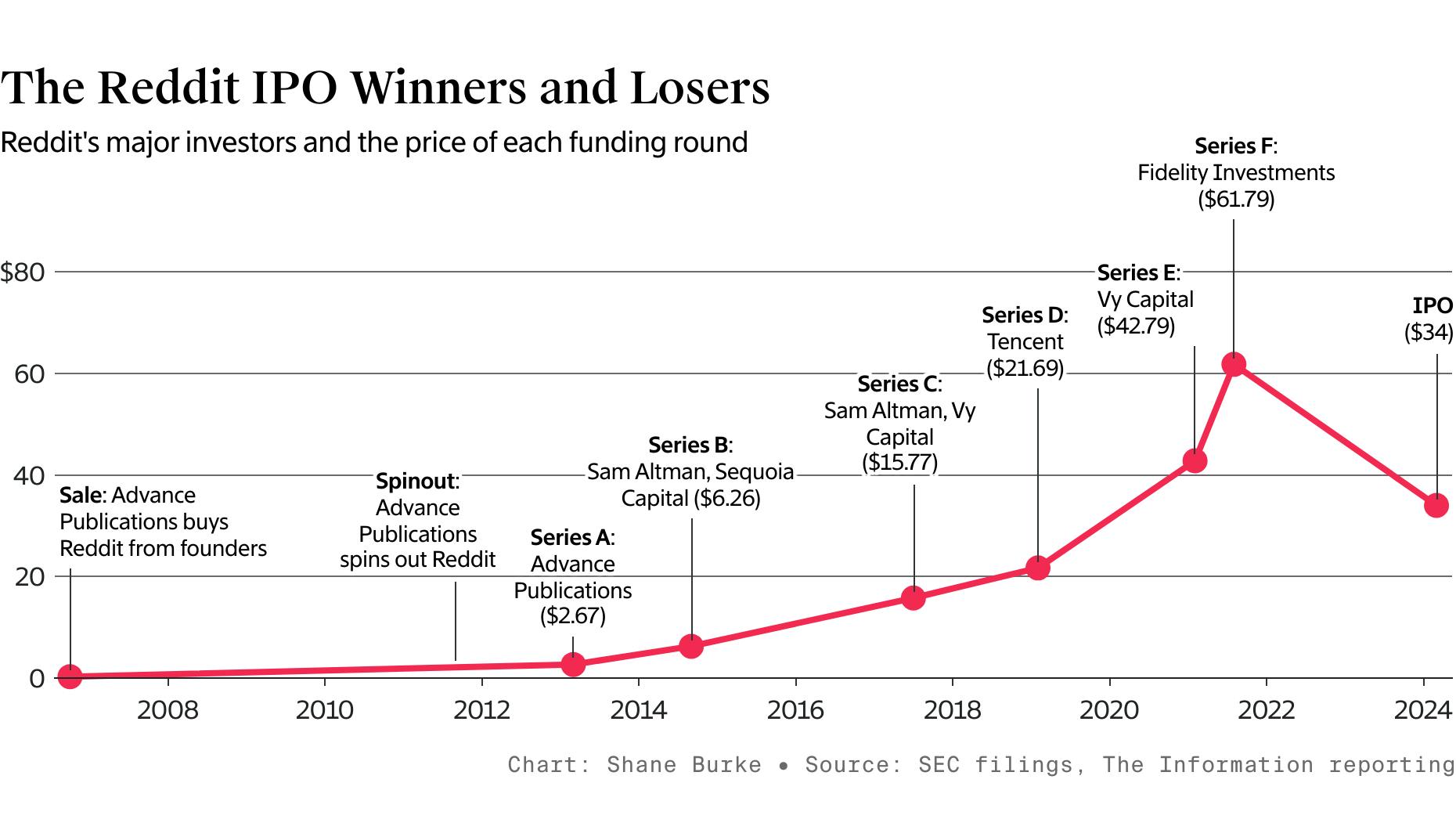

Nearly two decades later, traditional media is hobbled. But Advance just notched a huge win: It racked up a gain of $1.4 billion on the money it invested over the years in Reddit, far outpacing a cap table full of notable investors. The deal returned six to seven times the gains of the next biggest winner, a set of funds run by OpenAI founder Sam Altman, and 17 times the gains of Sequoia Capital, which invested about midway through Reddit’s 19-year existence, according to calculations and estimates by The Information.

The Takeaway

- Condé Nast’s parent company is reaping a gain of roughly $1.4 billion, or more than 1,300%, on its investment in Reddit, according to The Information analysis.

- That’s a much bigger return than those of investors like Sam Altman, Sequoia and Fidelity.

- Reddit’s IPO priced Wednesday and starts trading Thursday.

Powered by Deep Research

Reddit’s initial public offering priced Wednesday at $34 a share, valuing the company at $6.4 billion, and begins trading Thursday. It likely crowns Advance’s bet on Reddit as the most successful in old media’s tumultuous history of tech and digital media investments, which include NBCUniversal’s bets on BuzzFeed and Vox, as well as Advance’s own investments in troubled e-commerce sites Farfetch and Rent the Runway. The IPO is also a significant moment for the Newhouse family, the private ultra-rich New York clan that has owned Advance for more than a century. It will come about 13 years after Advance decided to spin out Reddit from Condé Nast, keeping most of its ownership stake but allowing the startup to raise new money from venture capitalists and issue equity to employees.

“The Newhouse family is the oddball in the Reddit cap table. Everyone else is tried-and-true tech, early investors,” said Ben Huh, an internet entrepreneur who is friends with Alexis Ohanian, a Reddit co-founder. “For the Newhouse family, this was so out of the ordinary for them. They made an early big bet.”

Major Reddit investors that showed up later, after a merry-go-round of messy CEO changes and after the company started building an advertising business, will likely boast less rosy returns. Those include Tencent, which stands to gain about 22% over five years on the more than $400 million it invested starting in 2019, significantly less than it would have gained if it had invested in the S&P 500 during that period. Another is mutual fund Fidelity Investments, which bought more than half its 8% stake in the company at a $10 billion valuation in 2021, filings show, far above where Reddit priced its IPO.

Reddit’s strange corporate history has created some cap-table quirks. One of its largest shareholders is San Francisco–based Quiet Capital, which acquired a large chunk of its stake over the last few years through purchases on the secondary market. Some of the biggest Silicon Valley investors that own stakes, Sequoia and Andreessen Horowitz, invested a relatively small amount after the Condé Nast spinoff in 2011 and declined to double down later. Y Combinator, which helped make Reddit famous, won’t gain anything because it cashed out when Condé acquired the company.

Reddit co-founder and CEO Steve Huffman, who has run the company since 2015, will also benefit from close ties to Advance executives. Not only will he get a proxy on Advance’s voting rights after the IPO, but he received a new compensation package last year worth $193 million ahead of the IPO.

Advance’s big win is, like many startup bets, the result of a mix of luck and foresight. Interviews with three former Condé Nast executives and employees involved in Reddit said the New York–based media company took care to avoid meddling too much with the internet startup, which worked mostly out of San Francisco. For instance, Condé Nast didn’t pursue early plans to integrate Reddit’s technology into the system for online comments that other Condé publications used, said Rajiv Pant, who oversaw Reddit’s small team for a few years after the acquisition as Condé Nast’s vice president of digital technology from 2007 to 2011.

“You hear that big companies acquire an exciting startup, but afterwards it doesn’t work out because the big company starts bringing in their processes and micromanaging the people,” Pant said. “We didn’t do that at all.”

The hands-off approach also meant Condé didn’t invest all that much in Reddit—or build a revenue-generating business from it—in the seven years the publishing group fully owned the site. Cultural battles with Reddit’s male-coder–heavy user base, including an incident where Reddit spread information on how to hack into Sears’ website, created internal headaches. Other Silicon Valley–based Reddit investors complained privately that Condé Nast had neglected Reddit.

The financial crisis in 2008–09, combined with changing news-reading habits, cut into Condé Nast’s profits, hastening a spinoff so Reddit could raise capital independently and build up its own advertising team. “They didn’t want it to turn into a money pit,” a former Condé Nast executive said.

Here’s how the rest of the cap table will fare starting with the earliest investors, based on public filings, people familiar with the investments, and estimates. Actual returns, of course, will depend on how the newly public company’s stock performs and when investors decide to sell their shares.

Advance Publications

Advance executives, including Steven Newhouse, who is in the third generation of the Newhouse family to ascend to the top ranks of Advance, gravitated toward the purchase of Reddit to bolster the publishing group’s appeal to young men and get a deeper toehold in digital media when print was still king. Other traditional media firms had already gotten a bite of social media fervor—News Corp, for instance, had bought Facebook rival MySpace in 2005.

Reddit, which had just gone through Y Combinator, sold to Condé Nast only 16 months after launch. At the time, Reddit had amassed 1 million readers a month, according to the book “We Are the Nerds,” a history of Reddit published in 2018. The sale made its young co-founders rich, but they implied later they had some regrets about the sale. “A million dollars isn’t as much as I thought it was,” Huffman later told Forbes.

In the ensuing years, Condé Nast talked about buying or investing in young media and social upstarts like PopSugar, Pinterest and even Snap, said a former Condé Nast executive involved in Reddit. But in Reddit, “we realized we could have a gold mine on our hands.”

One problem was that Reddit users often revolted against any effort to make money from the site, including advertising. To keep costs down, Condé Nast kept Reddit’s staff lean, with only a handful of engineers. (We estimate it sunk less than $50 million in operational costs, including cloud computing and staff bills, into Reddit over the years.) Reddit had just 28 employees when Advance spun it out in 2013, as the site grew to 1.5 billion monthly page views and high-profile people like President Barack Obama wrote “ask me anything” interview responses on the site.

The media company kept a majority ownership stake but needed to offer competitive equity compensation to employees, the then newly appointed Reddit CEO Yishan Wong, a PayPal and Facebook alum, said in a 2012 interview.

Wong recruited angel investors such as Keith Rabois, Josh Kushner and Marc Andreessen. Advance put up most of the capital in the round. “We’re kind of a startup, kind of an established player, but mostly Reddit is a work in progress,” Wong said in 2012.

Advance didn’t participate in the Series B round the next year but maintained a majority stake through 2019, before Reddit raised money from Tencent. Advance’s stake has been diluted substantially over time. It owned about 30% of the company before the listing, still making it by far the largest shareholder. “Thirty percent of the IPO valuation is a whole lot more than 100% of what it was worth a couple years in,” a former Condé Nast executive said.

Theoretical return on estimated $100 million investment: 1,335%

Value of stake at IPO: $1.4 billion

Sam Altman’s Funds

In 2014, Altman was in his first year of running startup school Y Combinator when he put about $27 million into Reddit, a site he said he visited daily and thought was undervalued. “I was probably in the first dozen people to use the site, and I shudder to imagine the number of hours I have spent there,” he wrote in a blog post announcing that he was leading the round, which valued the company at $500 million even before it had really figured out how to make money.

Altman, who joined the board, wrote in a Reddit post after the funding round that he didn’t know yet how Reddit would amass financial value. “Honestly, anyone who tells you they can do it precisely is lying. I made a few models but ended up using them only for very rough guidance,” he wrote. Like other investors in the round, he received warrants that gave him the right to purchase shares at a discount to the next Series C round, growing his stake.

Altman’s support helped Reddit power through the next few rocky years. Wong quit soon after the funding round, following a dispute over whether to move Reddit to suburban offices in Daly City, Calif. The company’s next CEO, Ellen Pao, faced a barrage of racist and sexist comments from Reddit’s users. Altman helped bring back Huffman as CEO and participated heavily in the Series E and F rounds. Filings show he invested between $100 million and $150 million overall through his various venture funds, including Hydrazine Capital. (The exact amount of money he invested couldn’t be learned.)

OpenAI, which Altman co-founded in 2015, is listed in Reddit’s IPO filing as a competitor because of its chatbot, ChatGPT.

Theoretical return on estimated $100 million to 150 million investment: 120% to 240%

Value of stake at IPO: $415 million

Sequoia Capital

Sequoia’s storied name has been tied to Reddit for more than a decade, contributing to the site’s semblance of Silicon Valley legitimacy. But Sequoia only invested about $16 million in the Series B, later sold stock warrants it was awarded, and didn’t double down in later rounds.

A bit of financial engineering from years ago helps Sequoia’s returns look better, however. The firm sold warrants, or rights to receive shares at a discount in the future, to other investors before the Series C round for about $10 million. That essentially lowered the initial cost of investment to about $6 million.

Overall, Sequoia and other early venture capital firms that considered investing in the company post-spinoff found it an awkward fit: Its valuation and age looked more like those of a late-stage investment, but its business looked early stage. The result is an investment that boasted solid returns, but will mark only a relatively small win for Sequoia.

Theoretical return on blended $6 million million investment: 1,250%

Value of stake at IPO: $81 million

Vy Capital

Former Goldman Sachs banker Alexander Tamas made a name for himself leading a 2009 home-run investment in social media upstart Facebook for Yuri Milner’s DST Capital. He left in 2013 to start his own firm, Vy Capital, which has invested in Elon Musk ventures like SpaceX and Neuralink.

The firm invested about $70 million in the company’s Series C out of its first fund in 2017, just after Huffman’s return. That stake has roughly doubled since then. But Vy watered down those gains by investing about $125 million in Reddit’s last two funding rounds in 2021.

Theoretical return on estimated $195 million investment: 25%

Value of stake at IPO: $245 million

Tencent

By 2019, Reddit was finally becoming a real business. The company had just brought in more than $100 million in revenue for the first time. “I think our users understand that we want to be a business,” Reddit Chief Operating Officer Jen Wong said the year prior. The website’s traction and unique user base attracted Tencent executives James Mitchell and Dan Brody, who struck a deal to invest about $250 million in Reddit at a $3 billion valuation, filings show.

China’s Tencent, a videogame company also known for chat app WeChat, had been using a slew of investments to expand its empire overseas during the 2010s. Those included investments in Snap and Spotify, as well as game makers Epic Games and Activision Blizzard—deals that likely would have attracted more scrutiny from lawmakers in today’s geopolitical environment.

In some ways, the investment was a strange fit: China blocks access to Reddit. Huffman explained the deal more simply: “They are investors in lots of videogame companies,” he told CNBC. “And videogames are one category that’s really popular on Reddit.”

Theoretical return on estimated $417 million investment: 22%

Value of stake at IPO: $509 million

Quiet Capital

Reddit had already raised all of its rounds of funding by the time it first submitted its IPO filing, showing the major shareholders owning at least 5% of the company, in late 2021. San Francisco–based Quiet Capital wasn’t in that group.

But by the time Reddit made an updated filing public this year, Quiet owned nearly 7% of the company.

The firm, which had gotten to know Reddit executives over the past decade and first invested in the 2017 Series C, quietly gobbled up shares from early employees and investors on the secondary market in recent years, although it’s unclear what price it paid. Roughly 28% of its stake is common shares, the filing shows, meaning it likely purchased them from employees or executives. The vast majority of its transactions were at a price lower than the planned IPO price range, a person close to the firm said, although how much it invested in Reddit stock overall couldn't be learned.

Value of stake at IPO: $326 million

Fidelity Investments

Mutual fund Fidelity, known for making big bets on pre-IPO companies, made its first investment in Reddit in 2017 after Huffman came back. It put about $5 million to $10 million into the Series C, a deal that would have a nice return—in theory.

But the vast majority of its investment came at a peak valuation that Reddit hasn’t come back from. Fidelity invested $400 million at a $10 billion valuation in 2021, pushing its stake underwater. Mutual fund filings show the firm also owns tens of millions of dollars’ worth of shares from Reddit’s Series B and D rounds as well, although it’s unclear how it bought those stakes.

Value of stake at IPO: $399 million

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.