Faded Hype for Real Estate Tech Leaves Cadre, Others Scrambling

Ryan Williams, CEO of Cadre. Photo by Bloomberg.

Ryan Williams, CEO of Cadre. Photo by Bloomberg.A flock of big-name investors—Andreessen Horowitz, Thrive Capital, Founders Fund and even Jack Ma and George Soros—piled into Cadre six years ago at an $800 million valuation, seeing potential in its promise to bring commercial real estate investing to the masses. The company, co-founded by Jared Kushner and former Blackstone employee Ryan Williams, told investors then that its “addressable market opportunity is $100+ trillion.”

But the New York–based company failed to fulfill those big expectations. Last year, it told investors it would likely pull in less than $30 million in annual revenue and wasn’t yet profitable, according to people familiar with the matter. That has made its latest fundraising effort even more difficult. Over the past six months, the company has struggled to raise tens of millions of dollars, the people said.

The Takeaway

Powered by Deep Research

Cadre is just one example of how, for executives and investors across the startup world, fundraising talks have become increasingly tense, particularly for firms in sectors like real estate technology. They face a toxic combination of rising interest rates, which have curtailed home and office sales, Covid-19–prompted office vacancies, and cash burn, all of which have dampened investors’ interest in them.

One deal Cadre discussed was raising a type of debt that would allow investors to convert their cash into equity at a valuation ceiling of about $100 million if the company raised more money from other firms, the people said. Another person who said they were raising money on behalf of Cadre pitched prospective investors on a deal that would have valued the company at $155 million, a roughly 80% drop from its previous valuation, according to a message to investors viewed by The Information. The current status of Cadre’s fundraising talks is unknown.

Cadre pools money from accredited investors to invest in apartment and office buildings, and says it uses predictive models and other software tools to get better investment deals. Patrick Lovett, a Cadre spokesperson, disputed details of the company’s fundraising efforts and financials. “We believe our proven track record, which stands at 27.6% net [internal rate of return] and over $460 [million] in gross distributions, speaks to our continued ability to provide compelling value to our clients and investors,” he wrote in an email.

So far this year, private investments in real estate startups have fallen off a cliff. The average pre-money valuation of property tech firms around the world has been at its lowest level this year, $64 million, since 2013, according to PitchBook. The sector is on pace for its lowest level of new funding since 2015 and would be down 75% from its record high in 2021.

The slow funding environment will require companies to make compromises if they need cash. “The theme of this year will be creative restructurings,” said Nima Wedlake, a principal focused on real estate tech at Thomvest Ventures. He said companies needed to lower price expectations to give employees more reason to stay and to entice new investors.

“We have to take our medicine,” he said.

Other companies in real estate tech are raising money at more investor-friendly terms but avoiding putting a new price on their shares. Orchard, a home-buying startup backed by Navitas Capital and FirstMark Capital that was valued at $1 billion in 2021, raised money late last year by giving investors a guarantee it would return 2 times the capital they put in, a person familiar with the matter said. The company raised money in a down market because it was burning too much cash, the person said.

Placemakr, a startup backed by property developer Vornado Realty Trust that uses apartment buildings to offer short-term stays, recently raised $65 million. As part of the round, it gave investors the right to receive additional shares in the future if it doesn’t raise its next round at a higher valuation than at its previous fundraising, said Jason Fudin, the company’s CEO. “Determining valuations is definitely less straightforward than in the past,” he said. He added that the company has “always been highly disciplined with our burn relative to growth.”

Hype Cycle

Over the past half-decade, dozens of startups minted valuations close to or above $1 billion with a business model of hiring expensive software engineers to develop digital products that could improve the very human-driven process of buying homes, selling commercial buildings, improving office spaces or opening hotel-like properties. Investors, lured by the enormous size of the real estate market, dubbed the category “prop tech.”

Some top venture capital firms, including Andreessen Horowitz and Khosla Ventures, each of which invested in Cadre, targeted the real estate sector as one tech startups could shape. Traditional real estate firms, including office developer Tishman Speyer and homebuilder Lennar, also launched VC arms.

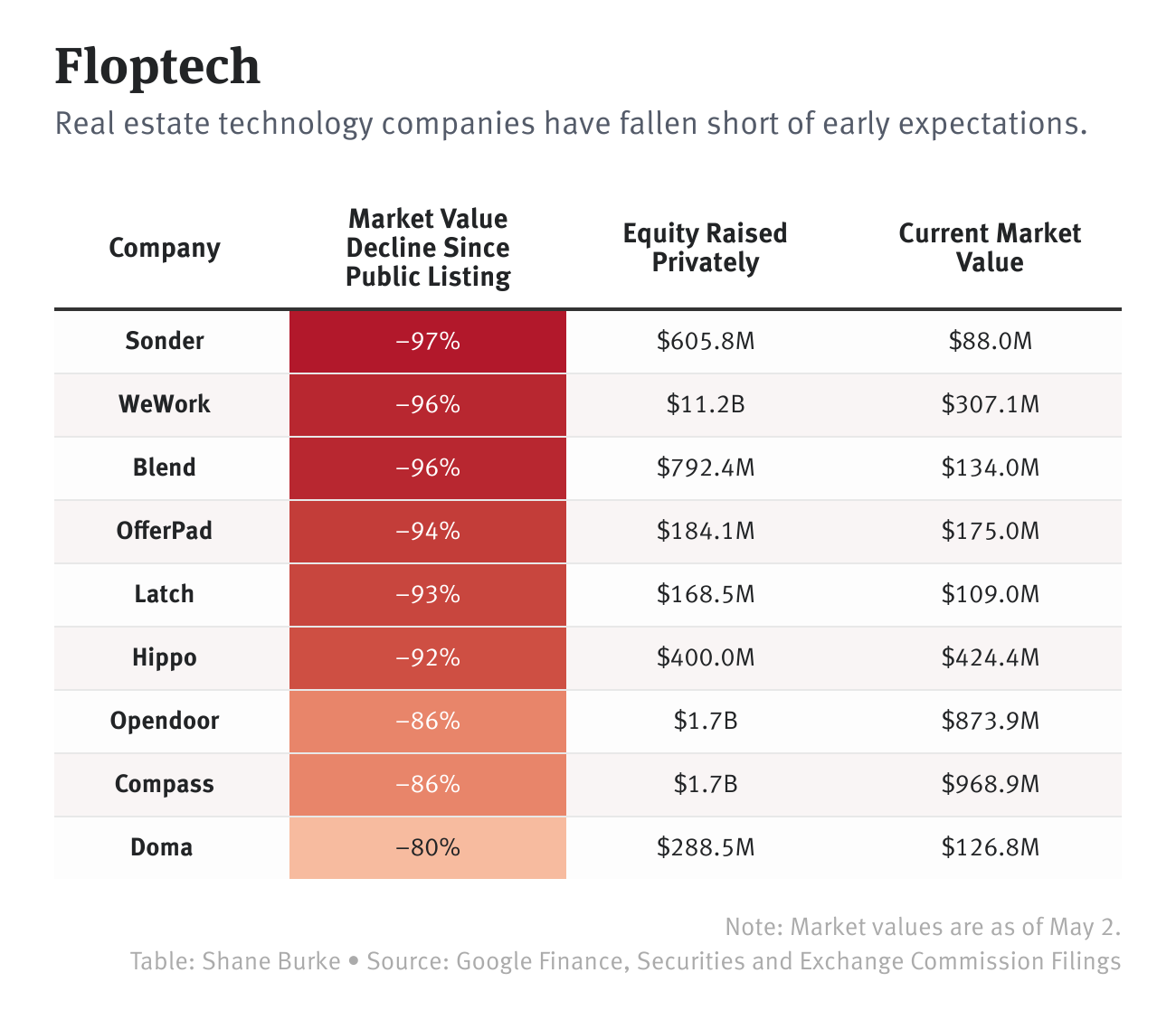

But when some of those prop tech firms went public, largely by merging with special purpose acquisition companies, the response from public market investors was less enthusiastic. At least eight venture-backed real estate firms that went public over the last few years—including WeWork, Opendoor, Sonder and Compass—now have a market value below the amount of private capital they raised, putting investors deeply underwater. Those companies have all seen their valuations fall at least 80% since their public listings.

Wedlake said many publicly traded and private real estate tech firms have been hit by a slowdown in the home and office sales that help drive their businesses. At the same time, rising interest rates also curtailed investor interest in more-speculative tech companies. “It was a double whammy,” he said.

Last year, Lennar said it would spin off its VC division because the losses on its investments were dragging down the earnings of its parent company. One of the startups Tishman Speyer took public in 2021 through a SPAC, Latch, which makes digital locks for apartment buildings, has lost 93% of its value since.

Then there’s privately held Cadre.

In 2017, the company predicted it would surpass $400 million of revenue annually in just a few years, first by allowing investors to buy and sell shares in commercial properties, and then by opening up other investment opportunities, like “illiquid credit, energy, timber, farmland.” Jeff Jordan, a partner at Andreessen Horowitz who had backed household names such as Airbnb, Pinterest and Instacart, wrote at the time that Cadre could “disrupt less efficient analog incumbents” by offering real estate investors lower fees.

As it turned out, Cadre struggled to compete with larger, more traditional real estate private equity funds, according to two people familiar with the business. Its ties to Jared Kushner, President Donald Trump’s son-in-law, also appeared to hurt it. SoftBank discussed investing in Cadre at a $2 billion valuation in 2018 when private startup investing was booming, but it pulled out because Kushner wouldn’t divest his ownership, Bloomberg reported.

Cadre has new growth goals. Late last year, it told investors it hoped to reach $120 million in net revenue by 2025, a person familiar with the matter said, as it pitched investors on raising new cash to help it get there.

Zach Aarons, general partner at real estate tech investor MetaProp, said real estate investment management was still a “pen-and-paper and Excel-driven world,” which left opportunity for more tech firms to take market share. But, he added, investors should no longer invest in those companies at high valuations similar to those for enterprise software firms. “That’s what the last few years have exposed,” he said.

‘One Sweet Moment’

Other real estate tech firms that raised at high valuations are walking a tightrope. One is Divvy Homes, which raised money at a $2 billion valuation from Tiger Global Management two years ago. The company buys homes in the U.S. and rents them to people who don’t have the credit history or savings to buy, but who hope to eventually purchase the homes.

The company has conducted two rounds of layoffs since the fall. In November, it said it would take a more conservative approach to expansion by only bidding for homes 10% to 20% below their listing price. “We’re completely comfortable with slow growth in the current macro,” CEO Adena Hefets said in an email. She said the slower approach would also help its customers.

Hefets said the company’s net revenue grew 70% in the first quarter, compared to the same period the previous year. The company makes money not just on selling homes but also by collecting rent from tenants. “Unlike peers, we have strong recurring revenue, [we] have been diligent on risk and capital management, and we’ve had success in setting up ancillary services like Title that also drive revenue,” she added.

Still, the moment has humbled some real estate tech executives who chased high valuations. Better.com, a home mortgage startup, struck a deal last year to go public through a SPAC at a $7.7 billion valuation. But the deal has been on ice, and the company may raise more money privately at a lower valuation, CEO Vishal Garg told The Information in March.

Two years ago, digital real estate brokerage Side raised $150 million from investment firm Coatue Management at a $1 billion valuation. Guy Gal, the startup’s CEO, told The Information at the time that the funding announcement was “one sweet moment I was looking forward to.” The firm raised even more money a few months later at a higher price from Tiger Global.

At a company conference in February, Gal made light of the new reality. “I remember many of you saying, ‘I can’t wait until we have a market like this one that is contracting, that is more challenging.’ Here it is. Thanks a lot!” he said.

Maria Heeter is a New York-based reporter at The Information with a focus on deals and corporate finance. Have a tip? Call or text at 6033197139 (cell, Signal or WhatsApp) or email [email protected].

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.