Why Stripe Is Cheaper Than Adyen

Photo by Bloomberg.

Photo by Bloomberg.Stripe has been blessed with a few big advantages over its Netherlands-based digital payments rival, Adyen. Stripe serves smaller businesses, allowing it to take a bigger cut of each sale. The vast majority of its customers are in the U.S., a more lucrative market than that of the European-centric Adyen. The result has been faster growth for Stripe over the years, making it the largest digital payments processor by volume, analysts estimate.

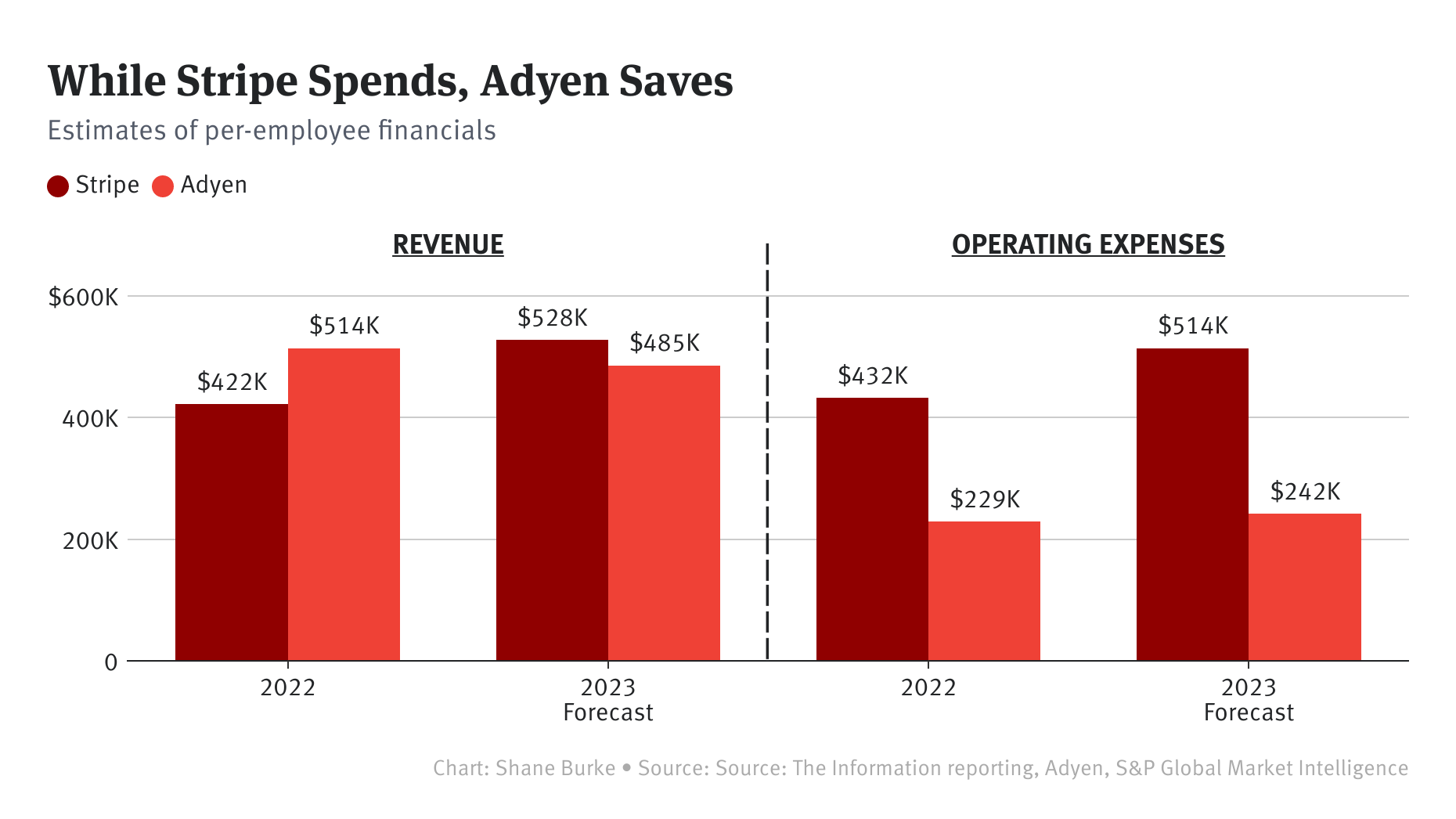

And yet the valuation at which Stripe is raising money right now, $55 billion, is at a huge discount to Adyen’s $44 billion public trading valuation, at least as a multiple of expected 2024 revenue for each company. What gives? Stripe is now growing more slowly than Adyen, thanks to the e-commerce slowdown. But that’s not all. Stripe spent so heavily on staff and new business initiatives in recent years that its 2022 expenses per employee were twice those of Adyen, even though Adyen’s revenue per employee was higher, according to an analysis by The Information. The expense gap is expected to stay the same this year, although Stripe is expected to do better on revenue per employee.

The Takeaway

- Stripe’s offering is pitched at a discount to Adyen’s public valuation

- Adyen’s expenses per employee are half those of Stripe

- Adyen is now growing faster than Stripe

Powered by Deep Research

For long-haul investors, that situation presents an opportunity. If Stripe is able to translate its investments in new business areas into faster growth over the next few years, investors jumping into its current $4 billion fundraising marketed by Goldman Sachs will be getting a bargain. As The Information reported on Friday, Stripe is close to raising the money although some investors think Stripe is too expensive even at the $55 billion valuation. (In our analysis, we're using net revenue, the money that flows directly to Stripe and Adyen after merchants and credit card firms take their cut.)

Over the long term—potentially many years or even decades—Stripe has told investors it could generate 60% operating margins, without accounting for interest, taxes, depreciation, amortization or stock-based compensation. That’ll be a steep climb—up from an expected 3% margin this year. (The company told investors its last three years of operating margins were 8%.)

But Adyen isn’t standing still. It is now trying to expand geographically and develop new products. As a result, executives have said they started to quicken their pace of hiring last year, and will continue to this year. Despite those investments, analysts expect Adyen to surpass 60% operating margins within three years, from about 55% now.

With higher interest rates sending investors searching for reliable cash flows, Adyen has built itself into a clear favorite for the times. Stripe’s picture is hazier. Investors are now trying to figure out how much Stripe can really increase its operating margins over the long term.

Indeed, Adyen shares are currently trading at 20 times expected 2024 revenue, while Stripe’s funding valuation of between $55 billion and $60 billion implies 11 times the 2024 revenue its executives have forecast.

Surprising Turn

An unfavorable comparison to Adyen is a surprising turn for Stripe, a startup brand that became a near-holy name in Silicon Valley. Its early rapid growth and exposure to the fast-expanding e-commerce market helped the payments firm raise more than $2 billion from some of venture capitalists’ biggest names over a dozen years. After it raised money in early 2021 at a $95 billion valuation, it was one of the most highly valued startups in the world.

In comparison, Adyen raised just $200 million as a private company, although it raised hundreds of millions when it went public in its 2018 initial public offering. Its current market capitalization is about $44 billion.

Adyen executives seem to be basking in the contrast. “We are not led by short-term trends such as the pandemic-related e-commerce,” wrote Adyen CEO Pieter van der Does in November, a week after Stripe announced it was cutting 14% of its staff. (Even with those cuts, Stripe likely will still spend about twice as much per employee as Adyen this year, The Information estimates. That raises the prospect that Stripe may have to do more cuts.)

Stripe’s heavy spending, compared to Adyen’s, reflects both where the U.S. firm is based as well as several strategic decisions it has made that have driven up expenses.

Most noticeably, Stripe has invested heavily in building out new business lines, including in enterprise software, issuing corporate credit cards and even cryptocurrency. These lines haven’t yet generated meaningful revenue. It has also invested deeply in other financial technology startups, trying to elbow out venture capitalists. Adyen has focused more directly on payments and has never acquired another company.

Thanks to a product development culture that obsesses over details, Stripe rarely hires contractors to help with development work but prefers to work only with in-house staff, people familiar with the matter said. Between 2019 and 2022, the company more than quadrupled its staff. (Adyen grew staff less than three times, according to UBS.) Competition for top San Francisco–based engineering talent meant Stripe had to pay a premium. The company pays software engineers $196,000 on average, compared to about $141,000 for Adyen, according to Glassdoor.

The result is that Stripe spent about twice as much on operating expenses per employee as Adyen last year, roughly $432,000 versus $229,000, according to an analysis by The Information. Yet last year Adyen’s revenue per employee was about $514,000, meaningfully higher than Stripe’s. This year the expense gap stays the same but Stripe is expected to post slightly higher revenue per employee than Adyen. (See chart for specific numbers).

That disparity helps explain why the smaller Adyen was able to clock in about $800 million more in earnings before interest, taxes, depreciation and amortization than Stripe did last year, even though Adyen’s revenue was less than half Stripe’s. Adyen had an Ebitda margin of 55%, compared with Stripe’s –2%. This year the margin gap is expected to be only slightly narrower.

(There are two caveats to the per-employee analysis: We are undercounting some of Stripe’s operating expenses because the figure it has given investors doesn’t account for stock-based compensation. But Stripe’s operating expenses do include cloud computing costs, whereas Adyen capitalizes those expenses on its balance sheet.)

At the same time, Adyen has caught up with and passed Stripe in growth. The U.S. firm averaged annual revenue growth of 58% between 2019 and 2022, according to financial statements that have recently come to light. But this year its growth is expected to slow to about 20%, the company has told investors. Adyen grew at an average rate of 38% in that same period, slowing to 30% this year.

Equity research firm Autonomous Research thinks Stripe’s current valuation should be lower, between $45 billion and $55 billion, given Stripe’s lower-than-expected operating margins and increasing competition from Adyen.

Stripe could still make meaningful progress on its other business lines, including financial management software and one-click checkout products. Its nonpayments businesses, including enterprise software, is relatively small, but could presumably stand on its own as a big company soon. About 9% of its revenue, or $280 million, last year came from those lines, Stripe told investors.

And Stripe says it’s making headway in signing up more big companies as customers, including Amazon and BMW. It now has over 100 customers that generate more than $1 billion in payment volume, up from just over 20 four years ago, the company told investors in its fundraising material.

That might come with some trade-off in profits, however; the percentage of net revenue that Stripe generates from its total payments volume has fallen steadily in recent years as it has taken on bigger clients that can negotiate prices down, according to analysis of financial information shared with investors. The benefit, of course, is that bigger clients are often more stable than startups.

Stripe’s ultimate message to investors in its fundraising material is telling: Both Adyen and Stripe could end up winners, with the digital payments market overall growing quickly. Stripe told investors that the market was “not a zero-sum game” between itself, Adyen and other players.

That might be true. But right now, with investors looking for sure bets, Stripe looks riskier.

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.