Chris Dixon Keeps the Crypto Faith

Andreessen Horowitz’s crypto king has made a fortune for the firm with his multibillion dollar gamble on the category, but now crypto is awash in falling prices, hovering regulators and negative headlines. Dixon isn't flinching—for now—as he continues to plow money into crypto startups.

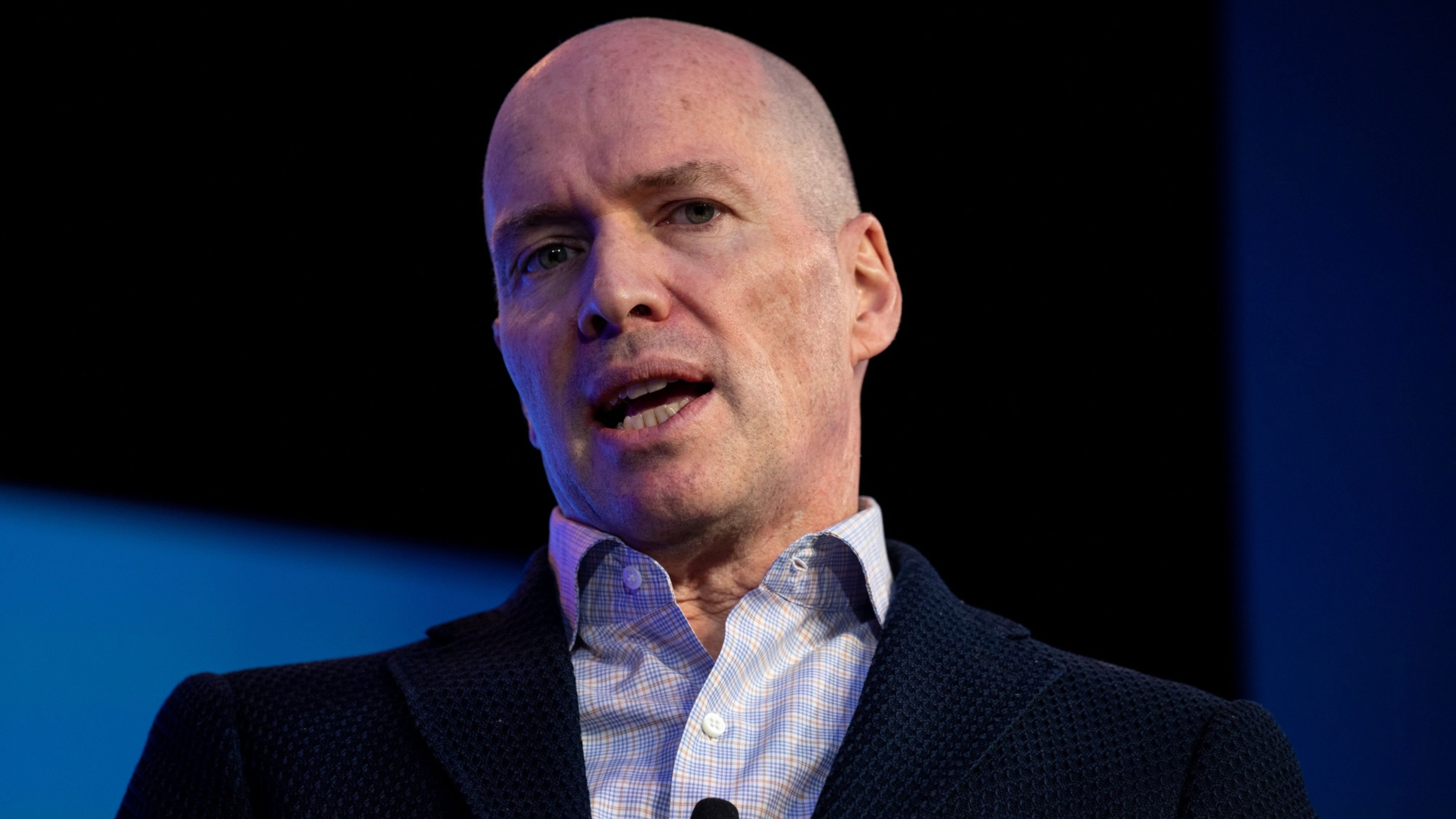

This summer, venture capitalist Chris Dixon settled down for a dinner conversation about politics, startup investing and the economy with business and entertainment executive Michael Ovitz at Ovitz’s 28,000-square-foot Beverly Hills mansion. At one point, the conversation shifted to a topic Dixon knows intimately: cryptocurrency.

Dixon—the leader of crypto investing at Andreessen Horowitz—had just helped raise the firm’s latest multibillion-dollar slug of cash dedicated to blockchain startups, a category of companies that was suddenly engulfed in grim news. The price of Ethereum’s coin was about three-quarters off its high last year, financial regulators were swarming around the sector, and entrepreneurs and investors had begun buzzing about a “crypto winter.” Dixon seemed unfazed by the turmoil, said Ovitz, who has been friends with Dixon for about a decade and a longtime adviser to Andreessen Horowitz.

“I will call him consistently, and if there’s some terrible headline, I’ll joke with him, ‘How are you feeling about crypto now?’ But he hasn’t wavered once,” Ovitz told The Information in an interview. “He doesn’t react. He just calmly says, ‘Nope, still long.’”

The Takeaway

- First A16Z crypto fund already realized three times gains for investors

- Troubles at OpenSea, Helium threaten Dixon’s record

- ‘Crypto conviction’ helped Dixon win early deals

Powered by Deep Research

Dixon has more riding on crypto than just about any other investor. He is the most prolific backer of crypto startups at a venture firm that has staked more of its reputation on the sector’s success than any of its peers. Over nearly four years, he has raised $7.6 billion for Andreessen Horowitz to plow into crypto startups, nearly three times the amount of money the entire firm—which goes by the nickname A16Z—had under management when Dixon joined in 2012.

Thanks to Dixon’s savvy bets on companies like Coinbase and Dapper Labs, Forbes this spring anointed him the world’s top venture capitalist. Arguably, he has become as key to A16Z’s future as the firm’s iconic founders, Marc Andreessen and Ben Horowitz.

Four years into its first crypto fund, a $300 million pile of cash, Dixon took advantage of the crypto boom to cash out a portion of its gains, returning to limited partners an amount roughly equal to three times the fund’s original size, according to a person familiar with the matter. The fund cashed out gains in bitcoin and ether, Coinbase stock and some crypto startups’ tokens, the person said.

The rest of the fund remains unrealized. On paper, it is on pace to return as much as 10 times its first fund to investors, two people familiar with the matter said, although that would likely shrink if the current crypto downturn persists. VC funds formed in 2018 had generated investment returns of about 1.7 times on average through the end of 2021, according to Cambridge Associates.

But blemishes have begun to appear on Dixon’s investing track record this year amid the crypto downturn. In March, Axie Infinity—a blockchain-based videogame made by Sky Mavis, a developer A16Z invested in—suffered a brutal cyberattack in which hackers swiped cryptocurrency worth $600 million at the time. And the number of transactions on digital art marketplace OpenSea, where Dixon sits on the board of directors, has plummeted.

“Those are unmitigated disasters,” said Liron Shapira. He is a Silicon Valley–based entrepreneur and angel investor who has amassed a Twitter following by editing video and podcast clips to poke holes in venture capitalists’ explanations of the potential uses for blockchain tech.

“A lot of skeptics have been arguing for a long time that these use cases are flawed,” added Shapira, who was an early investor in Coinbase before he became a crypto critic. “Now we’re seeing empirically the skeptic thesis play out and there’s been no amendment...There’s never been a retraction.”

A risky new model of VC Dixon has helped popularize, in which investors buy early stakes in crypto startups’ tradable tokens, is enmeshed in legal and financial uncertainty. For 18 such startups A16Z invested in, token prices have declined an average of 68% over the past six months. In April, Dixon’s firm and one of his more high-profile crypto portfolio companies, Uniswap, were sued by a token investor, who accused them of illegally promoting securities after the company’s token declined in value.

While some crypto founders have slowed their fundraising to avoid accepting lower valuations, Dixon’s team is still doing deals. In the past month, the firm has announced new fundings in Sardine, which offers fraud detection for cryptocurrencies; Arpeggi Labs, which uses blockchain tech for music collaboration; and Golden, which says its protocol “financially rewards participants for building a decentralized, permissionless graph of canonical knowledge.”

Dixon’s job could get harder as regulators investigate securities fraud related to non-fungible tokens and crypto exchanges. The Securities and Exchange Commission charged a former employee at Coinbase with insider trading and Kim Kardashian with failing to disclose that she was paid to tout a crypto security. The hazy regulatory climate has scared venture capitalists from sitting on boards of directors for several startups that sell tokens.

Dixon and the team of roughly 80 employees he has assembled inside A16Z’s crypto investing division have long sought to tune out critics, said Alex Pruden, a former crypto-focused partner at the firm. Dixon—who has a framed copy of the original Bitcoin white paper by Satoshi Nakamoto hanging on the wall of his home office—sought to hire new investors and other staff who saw cryptocurrency as a force to reshape different aspects of society.

“The culture Chris cultivated at that firm was: People were missionaries,” said Pruden, who now runs an A16Z-backed blockchain privacy startup, Aleo. “It’s early days. How do you measure success? It’s not a straightforward question. You just have to believe that success will come.”

Still, Dixon has privately fretted to colleagues that the gyrations of the financial side of crypto—including the collapse of crypto hedge funds and wild speculation on NFTs, unique bits of artwork and other digital assets connected to blockchains—have diverted attention from the promise that blockchain technology will fundamentally rewire the internet. He has even helped popularize an alternative term for the category—Web3—because associations with financial chicanery have so tainted the word crypto.

The Web3 future he paints can be intoxicating. Databases that run over networks of computers, called blockchains, can keep a transparent, secure record of transactions or decisions. People who use blockchain-enabled services can even get a financial stake in those blockchains, incentivizing them to grow the network and come together for governing decisions.

In the vision of Dixon and other Web3 acolytes, the result will cut powerful internet companies down to size. Musicians, writers, artists and other creators will get a bigger share of the pie. Users will be able to vote on whether their social networks should ban certain types of content. Big advancements in computing and security, along with a lot of advanced math, will enable it all.

Critics don’t buy the utopian crypto rhetoric. Even some of Dixon’s VC peers still have doubts about whether crypto can live up to its hype, said Adam Fisher, a partner at Bessemer Venture Partners. Many crypto projects sound good on paper but are far from proving they can dislodge or improve upon existing financial services, social networks or creative applications.

“You’ve never had a more polarizing segment of investment,” Fisher said.

“The overall [blockchain] model is ingenious. That’s why it’s attracted so many geniuses. But it’s predicated on speculation. You can’t separate the two. That’s new to high tech,” Fisher added. “It has attracted too many dollars and too many projects. I hope something great comes out of it. It would be a mark on our entire industry if nothing does.”

Through an A16Z spokesperson, Dixon declined to be interviewed for this story.

Getting the Bitcoin Bug

Friends, peers and former colleagues say Dixon’s eclectic background shaped his ability to market his ideas to entrepreneurs and to the public. The son of English professors, Dixon learned to code as a kid in Springfield, Ohio. He got interested in early versions of artificial intelligence, and studied philosophy at Columbia University, before heading to Harvard Business School in 2001.

After a stint at Bessemer Venture Partners, he started and sold two companies in the 2000s and early 2010s before he turned 40—a security startup, SiteAdvisor, which he sold to McAfee for about $75 million, and Hunch, an AI recommendation engine, which went to eBay for $80 million. He then became a prolific angel investor, writing checks to firms including Foursquare, Hipmunk and Kickstarter as he helped lead the relatively small New York tech scene that formed prior to 2008’s financial crisis. He began building a name for himself in startup circles with a blog offering advice for entrepreneurs about everything from naming startups to learning legal essentials.

Shaival Shah, a former Hunch employee who now runs real estate startup Ribbon, said Dixon was thoughtful, direct, geeky and “a little bit of an enigma.” He wasn’t one to make small talk, but he had clear advice about building a personal brand. Dixon once encouraged Shah to blog about his business ideas.

“You as an individual need to stand for something,” Shah recalled Dixon telling him. “You have to have an identity. You can’t just float.”

By the time Dixon moved to the West Coast in 2013 to join Andreessen Horowitz as its seventh general partner, he had caught the bitcoin bug. His fascination with the first cryptocurrency to garner mainstream awareness stemmed from his habit of studying “what the smartest people do on the weekends” as a way to forecast tech trends, he said at the time. “Today, the tech hobbies with momentum include: math-based currencies like Bitcoin,” he wrote on his blog.

In early 2014, just after making A16Z’s initial investment in Coinbase, he told Wired he thought a single bitcoin would someday be worth $100,000. It topped out last year at around $64,000 before dropping to $20,000 recently.

Around this time, Dixon also got a front-row seat for how the internet’s most powerful gatekeepers can pull the rug out from under smaller companies, which may have influenced his later passion for blockchain alternatives. In 2014, he led A16Z’s investment in media website BuzzFeed, which had turned into one of the internet’s most popular destinations thanks in part to a flood of traffic from Facebook. But Dixon, who sat on BuzzFeed’s board at the time, also saw the company’s growth hit a wall as Facebook tweaked its algorithm in ways that disrupted the free flow of eyeballs to BuzzFeed.

Dixon also benefited from investments in big tech companies. One of them, virtual reality startup Oculus VR, sold to Facebook in 2014 for $3 billion.

‘Red-Pilled’ by Crypto

In 2016, Dixon began expressing frustration in interviews with bickering among Bitcoin developers about whether to push it forward as a platform for commercial applications or remain focused on it as a digital currency. By the next year, though, Dixon found an alternative in the rise of blockchain platform Ethereum that seemed to change his attitude, according to people who know him.

Ethereum’s software, created by Russian-born programmer Vitalik Buterin, aimed to use blockchain technology and cryptocurrency to spin up a new computing network, rather than just create digital money. “Ethereum is why it clicked for him. You could have a new paradigm for computing that is community owned,” Pruden said.

Meanwhile, as the bull market for cryptocurrency roared throughout 2017, Dixon seemed to get “red-pilled” by crypto that year, a friend of his said, using an expression that refers to a moment when one grasps the truth of a situation. Dixon told the friend crypto was all he wanted to invest in.

Dixon got his wish. He began building a dedicated crypto fund within A16Z in 2018, recruiting Katie Haun, a former U.S. Department of Justice prosecutor who had sat on Coinbase’s board with him. The fund started with $300 million and a handful of employees. It registered with the SEC as an investment adviser—rather than a VC firm—so Dixon and Haun could legally invest its capital in cryptocurrencies, rather than being limited to taking equity stakes in private companies. The A16Z firm itself registered as an investment adviser the following year.

Dixon’s intensity about the future of crypto helped him best rivals to win key early deals. One was Anchorage Digital, a cryptocurrency bank valued at $3 billion that Dixon invested in five years ago. Diogo Mónica, the bank’s co-founder, said he first looked to raise money from Sequoia Capital because that firm had invested in his previous company, software maker Docker. But Sequoia didn’t have enough “crypto conviction,” Mónica said (the firm didn’t end up investing in Anchorage).

“There was no one else that had more conviction than Chris Dixon,” he said.

Dixon kept raising the stakes, pulling in $515 million in the spring of 2020 and $2.2 billion more about a year later for the firm’s second and third crypto funds. He and Haun built an independent team away from A16Z’s core operations, which gave them more control over their own staff for events, communications and other key functions.

They hired more experts from the fields of cryptography and engineering, and pulled in more investing partners from across the firm. The group’s Slack network buzzed constantly, with Dixon often asking the firm’s investors to defend decisions or explain why they had missed an investment opportunity. Despite standing an imposing 6 foot 4, Dixon doesn’t have a domineering in-person demeanor, friends and former colleagues say. He speaks softly, rarely name-drops and often wears Crocs around the office.

While A16Z hasn’t been involved in some of the crypto industry’s biggest flameouts—including those of crypto lender Celsius, which has filed for chapter 11 bankruptcy protection, and the collapsed stablecoins terra and luna—several of Dixon’s gambles have been duds. Last year, the token value of a cryptocurrency project called DFINITY, which looked to build a decentralized world computer—crashed by about 95% just after its initial coin offering.

And Helium—a much-hyped wireless networking startup, backed by A16Z, that rewarded people with tokens for setting up hot spots in their apartments—has run into trouble after accusations that it overstated its relationship with business partners. These allegations have intensified questions about whether the rewards promised to ordinary users of its products ended up disproportionately going to early executives and investors. According to a report in Forbes, half of the helium tokens mined went to the firm’s employees, their friends and family, and early investors.

Meanwhile, A16Z suffered a high-profile departure earlier this year when Haun left the firm just before it raised its fourth crypto fund, which totaled $4.5 billion when it was announced in May. Haun—who has started her own crypto investing firm, Haun Ventures—told The Information recently that her departure was amicable.

Now Andreessen Horowitz has pinned more of its future on crypto than any other mainstream Silicon Valley firm. About 22% of its assets under management are in funds dedicated to cryptocurrency and blockchain startups. VC firms at times have seen their reputations tarnished by premature technology bets, such as Kleiner Perkins’ failed investments in clean technology two decades ago.

“You can destroy your franchise if you go really big on something that turns out to be a mirage,” said Sebastian Mallaby, a senior fellow at the Council on Foreign Relations who wrote “The Power Law,” a history of the VC industry.

As crypto skepticism has spread, Dixon has said he is spending more time in online venues that are less hostile toward the technology. He recently began posting more frequently on Farcaster, a small social network used mainly by programmers and built on the blockchain. A16Z is backing the network.

“The contrast between the negativity on Twitter and positivity on Farcaster is striking,” Dixon wrote in early October on Farcaster, though his aversion to the tone on Twitter hasn’t prevented him from using it regularly.

Like many of his VC peers, Dixon has been spending less time in the San Francisco Bay Area in favor of New York and Los Angeles recently, said colleagues and friends. He keeps a relatively low profile online. He doesn’t have a LinkedIn account. His Instagram account mostly includes photos of food and restaurants. The Instagram account of his wife, Elena Silenok, doesn’t include any photos of her husband.

Ovitz, the entertainment executive, said he’s confident Dixon will be vindicated in his bet on crypto.

“When history is written, there’s always early people that missed it and early people who took a huge risk and then got it. Chris took a risk and he took a risk based on his instincts. He turned out to be right,” Ovitz said. “He’s already done really well.”

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.