Why the Two Biggest Winners in Instacart’s IPO Clashed

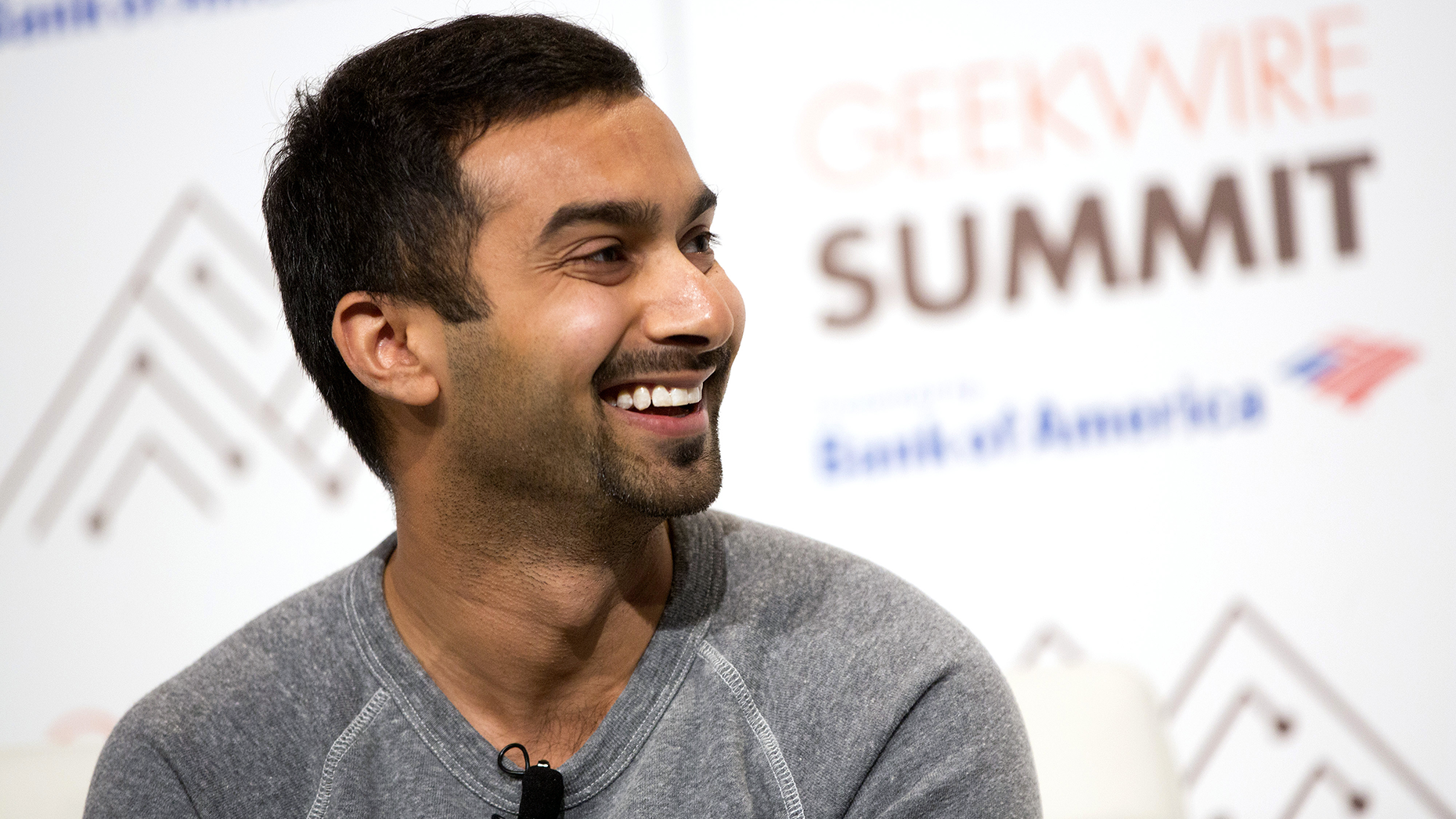

By far, the two biggest winners of Instacart’s long-awaited initial public offering next week will be the grocery company’s largest individual shareholder, co-founder and former CEO Apoorva Mehta, and its largest venture backer, Sequoia Capital. Mehta’s profit from the listing stands to be more than $780 million, while Sequoia could make more than $1 billion.

More than two years ago, the relationship between Mehta and Sequoia’s former boss Michael Moritz soured. Their disputes, which also embroiled other investors and elicited dramatic internal debate about the company’s leadership, helped delay the realization of those riches—and potentially undercut them.

The Takeaway

Powered by Deep Research

One reason Mehta frustrated investors was his reluctance to go public. Moritz and other investors urged Mehta to take Instacart public as stock markets roared and the pandemic accelerated the startup’s grocery volume growth to 300% a year. Other pandemic darlings like Airbnb and DoorDash had already held IPOs, and Instacart’s private valuation hit $39 billion. Mehta, however, pushed back, five people with direct knowledge of the discussions said. He didn’t want to go public yet, even after the company had already drafted an IPO filing.

Some investors, including Sequoia, perhaps more importantly grew concerned by Instacart’s executive departures and declining grocery volumes in some quarters following the pandemic growth spurt. Sequoia surveyed fellow investors to gauge interest in pushing out Mehta, said another person with direct knowledge of the matter. Some investors agreed, but support for sacking Mehta wasn’t broad enough, particularly in founder-centric Silicon Valley. Instead, Mehta stepped down as Instacart’s CEO that summer, effectively ending what he wrote had been his “life’s work,” after a scramble to see if rival DoorDash would buy the company. He told people at the time that he was burned out as CEO, which he had started a decade earlier by hustling his way into startup accelerator Y Combinator after a late application.

The messy 2021 episode—only flickers of which spilled into public view—had big implications for the nearly $3 billion worth of private investment that has poured into the company over the past decade, from blue-chip venture capital firms like Andreessen Horowitz and Kleiner Perkins to a cavalcade of hedge funds and mutual funds.

The reduced valuation at which Instacart is going public in a tougher IPO market—about $9 billion—has pushed several firms’ Instacart investments underwater in whole or in part. Investors likely to be under water on some or all of their investments include hedge fund D1 Capital, venture capital firms General Catalyst and DST Global, and mutual funds Fidelity Investments and T. Rowe Price, according to an analysis by The Information. T. Rowe, for instance, is on track to lose about 59% on its roughly $200 million investment, an analysis of public mutual fund filings shows. Some investors close to Instacart, like Sequoia, Andreessen Horowitz, D1 and Valiant Capital, plan to buy more shares in the IPO, backing Instacart’s new guard.

The Information calculated the estimated returns of Instacart’s early investors based on the $27 per share midpoint of Instacart’s tentative pricing range, as well as on information learned from private documents, public information from Instacart’s securities filings, and people close to the company.

Employees who helped build Instacart also stand to make much less money than they thought they would, especially those who joined late. The stock grants the company issued them two years ago were valued then at four times the price Instacart plans to sell shares in the IPO. To be sure, if Instacart had gone public earlier, its stock would likely have lost value in the public markets as share prices fell broadly and startups faced especially severe punishment. (Other factors would also have weighed in, including the precise timing of when Instacart had gone public and how quickly its employees and investors had been allowed to sell stock afterward.) DoorDash, which went public in December 2020, saw its stock dip below its IPO price about 14 months later, shortly before the Federal Reserve started raising interest rates. The company’s stock is still roughly 20% below the IPO price.

Instacart’s listing on Nasdaq next week will reward investors that bought in more than a decade ago. Investors who expect to return more than 50 times their money include Khosla Ventures, Canaan Partners, Initialized Capital, SV Angel, FundersClub and Starling Ventures, according to The Information’s analysis. Some investors, including Initialized, already sold at least some of their stakes on the secondary market for private stock after Instacart’s valuation had ballooned, people familiar with the matter said.

“It’s a classic example of people who invested in the seed round did extremely well,” Vinod Khosla, the prominent venture capitalist who runs Khosla Ventures, told The Information. He called its Instacart investment, made out of the firm’s $300 million seed fund, a “fund returner.” The firm stands to return about $275 million on its roughly $6 million invested, The Information estimated.

“The people who invested in the hype parts aren’t going to do as well if the hype doesn’t sustain,” he added, referring to firms that invested later.

From the outside, Instacart managed a somewhat smooth CEO transition, despite the internal drama. In July 2021, Mehta handed the CEO job to former Facebook executive Fidji Simo after the disagreements with investors over the IPO and following widely reported failed talks to sell Instacart to DoorDash. “Fidji will simply be a better CEO than me for Instacart’s coming years. I won’t pretend that it was an easy decision,” he wrote in a blog post then.

He later started another company, digital health startup Cloud Health Systems, which raised a round of funding last year led by Joshua Kushner’s Thrive Capital, also a relatively small Instacart investor. Mehta, 37, has remained chairperson of Instacart’s board, but plans to leave after the IPO next week, filings show.

Even after relinquishing the CEO title, Mehta maintained about twice the ownership stake in Instacart—10%—as Tony Xu, CEO and co-founder of DoorDash, did of his company at the time of its IPO. Instacart had at least a dozen investors in common with DoorDash, including Sequoia, Khosla and Kleiner Perkins.

Mehta, a high-energy former Amazon supply chain engineer, “was able to go and fundraise at opportune moments—market timing when investors were willing to pay top dollar and when business had the best story to tell,” said Shoaib Makani, who worked on Khosla Ventures’ seed investment in Instacart and now serves as the CEO of the supply chain tech startup Motive. Another investor remembered Mehta keeping information tight on the company’s business, forcing investors interested in a later round to only look at financial statements on paper in a closed room at the company’s office, rather than a more common virtual data room.

Instacart had a relatively simple origin story. Mehta wrote he started it “when I had nothing to eat but Sriracha in my apartment.” Some of its earliest investors did too. “It was a problem that resonated. I didn’t love grocery shopping,” Matt Huang, a former Sequoia partner who now runs the crypto-focused venture firm Paradigm, told The Information. He invested about $76,000 in the company’s seed round out of Starling Ventures, a small fund he started with friends, a document shows. The stake is now worth more than $11 million. He first met with Mehta at the now-defunct Creamery in San Francisco’s South of Market neighborhood, a haunt for founder-VC pitch dates.

The wedge between Instacart and Moritz occurred about a decade after the two men were drawn to each other. Moritz justified the investment in a 2013 interview by saying he had met a “wonderful founder named Apoorva Mehta.” Mehta told other investors at the time that he wanted Sequoia to lead the firm’s Series A round so he could work with Moritz, a legendary backer of Google and Yahoo.

The match was lucrative. Sequoia, which invested about $300 million over a decade, stands to return about $1.4 billion on that investment, the largest return by a wide margin of any outside backer in Instacart. (Its haul would have been five times that had the company gone public at its peak price.)

Moritz, who recently left Sequoia, is keeping ties to Instacart. He will stay on the company’s board.

Despite a diminished valuation, Instacart has still made it to its IPO with some business fundamentals likely to impress investors. The overhauled leadership team has gotten the company to profitability, thanks to a growing advertising business. Without question, the company has helped transform the grocery industry and provided a vital service during Covid-19 lockdowns. But it is barely growing, thanks to inflation and a curtailing of pandemic-driven online grocery shopping habits, which is likely to cool public investor interest.

Here’s how the rest of the cap table will fare, starting with the earliest investors. Actual returns, of course, will depend on how the newly public company’s stock performs and when investors decide to sell their shares.

Y Combinator

Instacart only caught attention from venture capitalists after it had almost been shut out of Y Combinator, the famed startup accelerator. Mehta applied two months late to the spring 2012 batch of the accelerator, the same class that included other YC success stories like Coinbase and software firms Zapier and Benchling. He wrote in a TechCrunch post that year, two months before the accelerators’ demo day, that YC partners had rejected him because of the late application. Garry Tan, another partner, told him it would be “nearly impossible for you to get in now.”

“That meant it was possible!” Mehta wrote in the post. He sent beer to Y Combinator’s office, addressed to Tan, using Instacart’s fledgling service. He talked for nearly an hour with YC partners about his ideas for the service and was accepted, he wrote. YC invested about $75,000 in the seed round, a stake now worth about $8.5 million. Tan’s other firm, Initialized Capital, also invested about $150,000 in the seed round, an amount now worth about $17 million.

Y Combinator later invested $30 million out of its growth fund in the Series D in 2017, a stake now worth about $45 million.

Theoretical return on $31 million total investment: 74%

Value of stake at IPO price: $54 million

Khosla Ventures

Mehta’s relentlessness stood out to investors at Khosla Ventures, who met with Mehta just before YC demo day when the entrepreneur was looking to raise a convertible note without a valuation cap in his seed round, meaning early investors would have owned a smaller share of the company as it raised more money. Investors convinced him to add a valuation cap to the note, saving their later stakes. Shernaz Daver, a Khosla spokesperson, said the firm also invested in the Series B and C rounds.

The firm stopped investing after that because it hadn’t yet started a growth fund, Vinod Khosla said. “We took the risk early,” he added.

Theoretical return on $6 million total investment: 4,580%

Value of stake at IPO price: $277 million

Canaan Partners

Instacart is perhaps the most well-known investment for Canaan Partners, a 36-year-old firm spun out of General Electric that also invests heavily in the healthcare sector. Hrach Simonian, a trained electric engineer, was fairly early in his VC career when he was scouring the Y Combinator class in 2012. “At the time we were all monitoring the early successes of Uber and Airbnb,” he said. Instacart, he added, “fit the thesis perfectly.”

Simonian took Mehta out for drinks at the Rosewood Hotel in Menlo Park, a frequent deal-making spot. They completed a deal soon after YC demo day, becoming the second-biggest check in the seed note, which rolled its equity into the Series A.The firm later participated in the Series B and Series C rounds.

Theoretical return on $2.6 million total investment: 7,579%

Value of stake at IPO price: $196 million

Sequoia Capital

The wedge between Mehta and Moritz developed nearly eight years after Instacart got its first investment from Sequoia, putting about $8 million in its Series A round of funding. Sequoia beat other investors to the punch, giving Mehta a term sheet right after he kicked off the fundraising process, one investor recalled.

Moritz was more than a decade past the embarrassment and financial losses that came with investing in Webvan, another grocery delivery startup that famously went bankrupt during the dot-com crash. In an interview in 2013, Moritz was matter-of-fact about how the investment came about. “Like a lot of investments that have come our way, a friend of a friend talked to us about it and told us about it and encouraged the founder and CEO to come and chat with us,” he said.

Sequoia invested in that early round out of its 14th venture fund, the same fund from which it invested in DoorDash, filings show. After participating in the B and C, it also led a 2017 Series D round when the company was starting to show strong signs it would eventually generate profits. The $50 million it poured into the now-overpriced $39 billion round in 2021 only pinched returns by about 3%

Theoretical return on $300 million total investment: 359%

Value of stake at IPO price: $1.4 billion

Andreessen Horowitz

By 2014, Instacart had expanded from just the Bay Area to 10 cities around the U.S. It could deliver groceries from major stores like Whole Foods and Costco. The firm caught the attention of Jeff Jordan, a partner at Andreessen Horowitz, who had already invested in Airbnb.

Jordan, who joined Instacart’s board, beat out several other firms interested in leading the Series B round—including Greylock Partners, DFJ, Menlo Ventures and Redpoint Ventures—a person close to the deal said. Andreessen Horowitz invested about $16 million in the B round, before participating in several other rounds.

Theoretical return on $126 million total investment: 101%

Value of stake at IPO price: $254 million

Kleiner Perkins

Kleiner Perkins was also in discussions to lead the Series B round, led by longtime investor John Doerr. Mehta was concerned that Doerr sat on the board of directors at Google, which had recently launched its own same-day delivery service, which Mehta saw as a potential threat, a person close to him said. Mary Meeker, then of Kleiner Perkins, told The Information the firm never gave Instacart a term sheet for that round but “we gained a lot of appreciation for Apoorva’s vision.”

Instead, Kleiner Perkins led the next round of funding, in a deal led by Meeker in 2015. Instacart had increased revenue more than 10 times the year earlier. Kleiner Perkins’ roughly $50 million investment in Instacart’s Series C was announced about two months before Kleiner Perkins’ Doerr announced a smaller investment in DoorDash, which was gaining traction with restaurant delivery.

Theoretical return on $55 million total investment: 98%

Value of stake at IPO price: $109 million

Valiant Capital

Valiant Capital was the first of three so-called “Tiger cubs” or "Tiger grand cubs"—hedge funds started by former employees of Tiger Management and its ilk—to become major investors in Instacart. The firm was one of several hedge funds and asset managers that started pouring money into startups in the middle part of last decade, as interest rates sat near zero and firms needed to look to the private markets for returns. Valiant had a good start by making a successful investment in Pinterest.

After an introduction by Sequoia, Valiant’s hedge fund put about $40 million into Instacart’s Series C in 2015. That early Instacart investment roughly doubled in value in the eight years since. Valiant’s later investment, out of its first venture capital fund called Peregrine in the fall of 2020, looks less attractive. It invested about $200 million in that round, at a $17.7 billion valuation, a mark that has declined by about half.

Theoretical loss on $260 million total investment: -20%

Value of stake at IPO price: $209 million

Coatue Management

Instacart had a problem before it looked to raise a round of funding in early 2018 that would raise its valuation to $4.2 billion. Amazon had just purchased grocery chain Whole Foods, a major partner of Instacart, fanning speculation about existential threats to the startup.

To fend off the competition, Instacart raised about $200 million from another Tiger cub, Coatue Management. The New York hedge fund had opened its first Sand Hill Road office five years earlier and started investing in private tech firms like Snap. Another New York-based fund and Snap investor—Glade Brook Capital Partners—was also a new Instacart investor that put money into the round. “We raised it because we want to win,” Mehta told Bloomberg at the time.

Theoretical return on $225 million total investment: 34%

Value of stake at IPO price: $302 million

D1 Capital

Dan Sundheim, an alumnus of Tiger Cub hedge fund Viking Global, struck out on his own in 2018 to start D1 Capital, a fund that would invest roughly half its money into private companies. Instacart became one of its signature startup investments when the firm invested that same year, after an introduction by Valiant Capital, a person familiar with the matter said. Sundheim later said he was drawn to Instacart because of its potential to build a large advertising business.

While that thesis has proven true, it hasn’t translated to a successful investment yet for D1, which invested at a higher price in that 2018 round than Instacart’s planned listing price. It also invested $125 million in later rounds that are more deeply underwater, the IPO filing shows.

D1 is listed in Instacart’s IPO filing as its second-largest outside holder, with about an 8% stake. (Grosvenor, an alternative manager affiliated with D1, owns another 2.5%.) Sundheim sits on the company’s board, and D1 has said it would invest more in the IPO.

Theoretical return on $875 million total investment: -16%

Value of stake at IPO price: $739 million

T. Rowe Price

Instacart pulled a typical move for companies on the brink of IPO by bringing in mutual fund giant T. Rowe Price to invest in 2020. But recent public filings show how poorly that went for the Baltimore-based investor. Across five separate funds, T. Rowe invested about $205 million at an average price of about $69 a piece. At the IPO mid-point price, it has lost close to 60% on that investment.

The mutual fund also appeared to buy shares from early investors, including about $58 million worth of shares from Series E investors at a $39 billion valuation, and $4 million from Series A investors at a $20 billion valuation.

Theoretical return on $205 million total investment: -59%

Value of stake at IPO price: $85 million

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.