These CEOs Wanted to Be Paid Like Musk. They Failed

CEOs Mario Schlosser of Oscar Health, David Baszucki of Roblox, Tony Xu of DoorDash and Vlad Tenev of Robinhood (left to right) received "mega grants" of stock, but are far from realizing any of the shares. Photos by Bloomberg and Getty Images. Background created with DALL-E 2.

CEOs Mario Schlosser of Oscar Health, David Baszucki of Roblox, Tony Xu of DoorDash and Vlad Tenev of Robinhood (left to right) received "mega grants" of stock, but are far from realizing any of the shares. Photos by Bloomberg and Getty Images. Background created with DALL-E 2.Elon Musk became the world’s richest person in part through a controversial pay plan four years ago that awarded him millions of additional Tesla shares as the company’s valuation swelled. Other tech CEOs took note. Many executives taking their companies public in the years following reached for similarly massive deals.

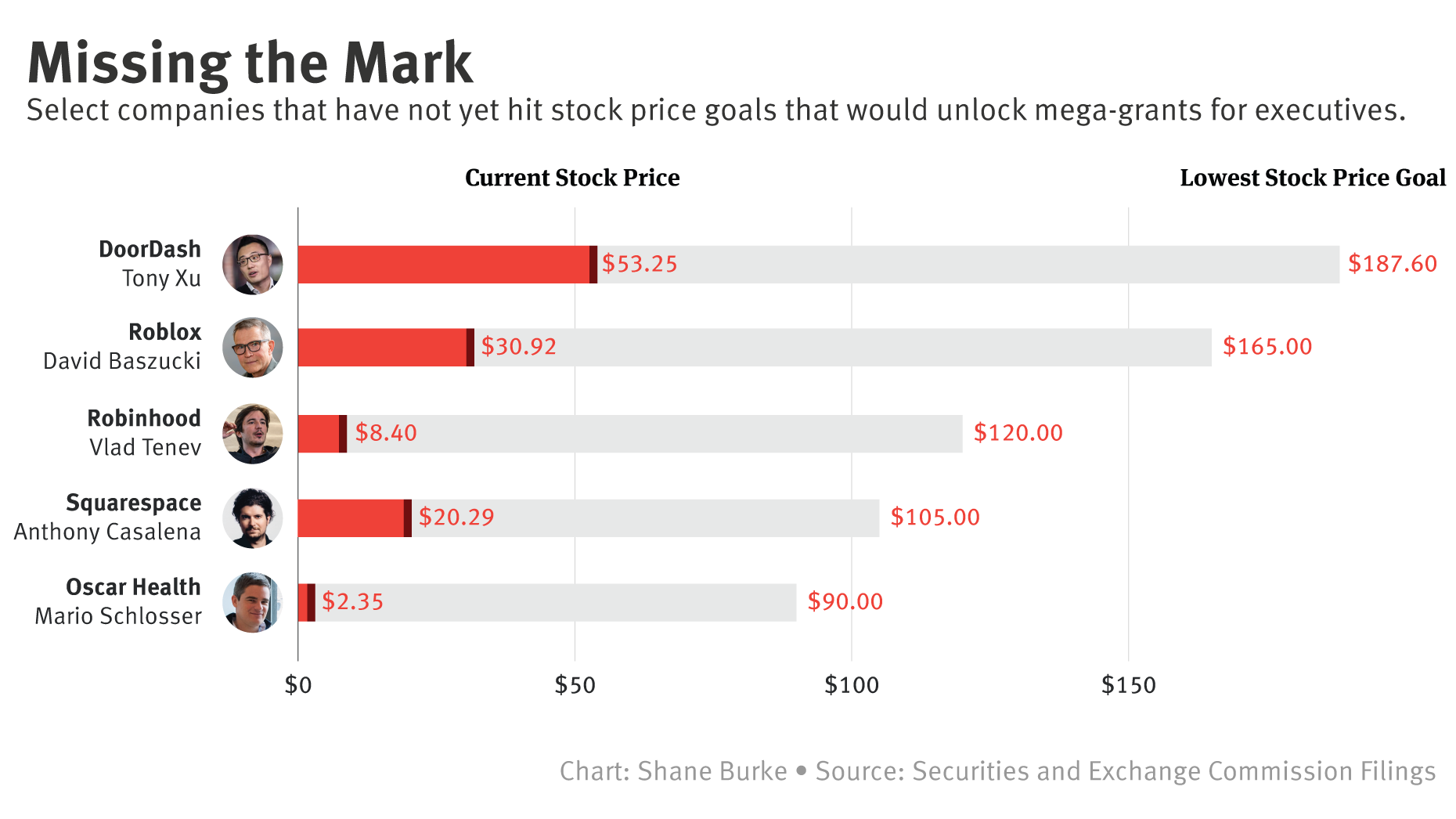

But it hasn’t gone nearly as well for most of them. Thanks to the downturn in tech stocks, many executives who received mega-grants before public listings have been left only a remote chance of hitting the stock price goals that would unlock more shares anytime soon, according to an analysis of securities filings by The Information.

The Takeaway

- 22 CEOs received “mega grants” of stock ahead of public listings in 2020 and 2021

- For many, the company’s stock price needs to at least triple for them to receive any shares

- Some executives and board members are discussing changes to lower the targets

Powered by Deep Research

For instance, shares at stock-trading app Robinhood, real estate brokerage Compass, and health insurer Oscar Health would need to rise at least twelvefold before executives at those companies earn any of their awards. Other companies canceled grants, or executives departed before they could earn awards that had been valued at hundreds of millions of dollars.

“They’re definitely high-risk, high-reward programs,” said Marc Hodak, a partner at executive compensation consulting firm Farient Advisors. “Management can be very poor at judging the risk-reward characteristics of their incentive programs at the time of adoption.”

Twelve of 22 tech companies that awarded mega-grants in 2020 and 2021 would need to at least triple their stock price for their executives to receive more shares, or their CEOs departed before receiving any of the award, according to The Information’s analysis. We define mega-grants, as some compensation consultants do, as packages that could give executives shares equivalent to at least 1.5% of the firm’s outstanding share count at the time of the awards. The grants are often, but not always, tied to the company reaching certain stock-price goals.

Companies disclose the estimated values of the stock grants in securities filings, but the stock paid out could be worth much more or less, depending on how the shares perform.

Robinhood’s stock price needs to grow 1,300% for CEO Vlad Tenev to vest any shares in an award once valued at $503 million. At Compass, shares must rise 1,100% for CEO Robert Reffkin to get any of an award that was estimated to be worth $89 million. Others far from getting new shares include DoorDash CEO Tony Xu, Roblox CEO David Baszucki, and Oscar Health co-founders Mario Schlosser and Joshua Kushner.

For most executives, including Tenev, Xu and Baszucki, the stock-price goals were aggressive, requiring the firm to nearly double or triple its initial public offering price for them to get any new shares. Others, such as Reffkin and Warby Parker’s co-CEOs, Neil Blumenthal and David Gilboa, had more modest goals—20% to 30% increases from the initial listing prices—that their firms haven’t hit.

Compensation experts said they expected some CEOs with grants that seem out of reach to quit because they have little chance of getting the stock. The experts said companies often award such large grants to motivate and retain founders who are already wealthy. The CEOs of scooter firm Bird, marketing software firm Marqeta and shopping app Wish stepped down this year amid company struggles and poor stock performance. Each had received large equity grants ahead of their company’s public listing that were tied to large increases in its share price. None of them earned any more shares.

To be sure, CEOs that stick around may have years to reach targets in the awards, which often have a lifespan of seven to 10 years. “These [grants] do have a long life with them,” Hodak said.

Tesla directors awarded Musk 20.3 million stock options in January 2018, contingent on the company achieving targets for market capitalization, revenue and adjusted earnings. At the time, Tesla was valued at roughly $50 billion. He would only receive all the options if the firm’s value topped $650 billion, which it did less than three years later. Today, those options are worth $3.6 billion, excluding the money Musk would need to exercise them and the taxes due on the gain.

Musk’s success inspired others to seek similar deals. Now some executives and board members are starting to discuss lowering the stock-price goals or changing the types of equity grants they award executives, according to several lawyers and compensation consultants who work with tech firms. Companies would have to notify investors of any changes in a securities filing and disclose changes in their next proxy statement, which details executive compensation. Businesses usually don’t need explicit shareholder approval for lowering share-price goals or creating new executive compensation plans, lawyers said.

Coupa Software, a San Mateo, Calif.–based firm that sells software to help firms track costs, awarded CEO Robert Bernshteyn a grant valued at $15 million two years ago; Bernshteyn would only receive the shares if Coupa’s stock kept pace with or outpaced the Nasdaq composite over the next three years.

Last year, as Coupa’s stock performance fell behind the index, Bernshteyn didn’t earn any of the shares. In July 2022, with the firm’s stock near an all-time low, the company said it had given Bernshteyn a new “special award” valued at an estimated $64 million if Coupa hit new stock price goals, most of which the firm didn’t disclose, over the next five years. For Bernshteyn to fully vest his shares, the firm’s stock price would need to quadruple over that period. The grant included shares roughly equal to 1.3% of Coupa’s shares outstanding.

Tom Gavin, the firm’s senior vice president of corporate marketing, said in a statement: “The stock grant for our CEO is focused on long-term retention and value creation during the next level of our company’s growth.” He added: “Coupa approaches compensation consistently at every level of our company. One of our core values is [a] focus on results—a value that is at the heart of compensation.”

Such moves, however, may stir resentment among employees and shareholders.

“Rank-and-file employees may see the rules changing for somebody at the top of the house and wonder, ‘Is this really fair?’” Jennifer Conway, a compensation attorney at Davis Polk, said on a public video call with executives and lawyers recently. She added, “If there’s hardly any chance the holders will ever see any value, it certainly is the right moment for the board and compensation committee to consider: Is there something that should be done here?”

Some firms have canceled their CEO mega-grants because the big pay packages limited how many new shares companies could distribute to employees.

One is Skillz, a mobile-gaming platform that went public at the end of 2020 through a reverse merger. In September 2021, Skillz announced it would give founder and CEO Andrew Paradise an additional 4% of the company’s outstanding shares—worth an estimated $71 million—if the company’s market capitalization quintupled from $4.7 billion over the next seven years.

Just seven months later, the company canceled the award after Skillz’ stock had fallen 79%. The firm said in a filing it canceled the grant to create room for it to issue new stock grants to employees after Skillz’ stock value had dropped. “The board and Mr. Paradise are continuing to discuss the terms of a potential equity grant,” the firm said in the filing. A Skillz spokesperson didn’t return a request for comment.

Such large stock awards can be controversial. Critics say the mega-grants often make wealthy tech founders even richer. Founders often already own significant chunks of their companies, which rise in value if those businesses perform well. A previous generation of successful tech executives, including Jeff Bezos and Mark Zuckerberg, became enormously wealthy without additional mega-grants.

Shareholders have filed suit against some companies that issued mega-grants, including advertising tech firm The Trade Desk, which awarded CEO Jeff Green shares estimated to be worth more than $800 million, contingent on the firm hitting stock-price goals. Shareholders at roughly 10% of the companies in the Russell 3000 index rejected executive pay packages in advisory votes this year, the largest share of rejections on record, according to audit firm PricewaterhouseCoopers. To reduce the pushback from shareholders, some companies say they don’t plan on giving executives more equity outside the mega-grant.

For some executives, mega-grants have proved lucrative. Trevor Bezdek and Doug Hirsch, co-CEOs of GoodRx, a Santa Monica, Calif.–based healthcare tech firm, will each nearly triple their number of shares in the company after it hit stock-price targets during its first months as a public company, in 2020. They qualified before GoodRx’s stock fell 88% over the past year, and they will take ownership of those shares within the next two years, GoodRx said in its securities filings. The additional shares are valued at about $46 million for each of them, based on the current stock price.

Alexander Karp, CEO of Palantir Technologies, got a compensation package valued at $1 billion ahead of the company’s public listing two years ago. Palantir didn’t attach any stock-price targets to the award. Instead, Karp will get about 178 million new shares over the next decade, which vest automatically every quarter. Some of the shares will come as stock options with an exercise price about 63% higher than Palantir’s current share price. More than 60% of the value of his award is in stock units that don’t have stock-price targets.

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.