How Anduril Is Fueling VC’s Push Into Defense Tech

Left to right: Palmer Luckey, co-founder of Anduril; Ryan and Brandon Tseng, co-founders of Shield AI. Photos via Getty, Shield AI and Anduril.

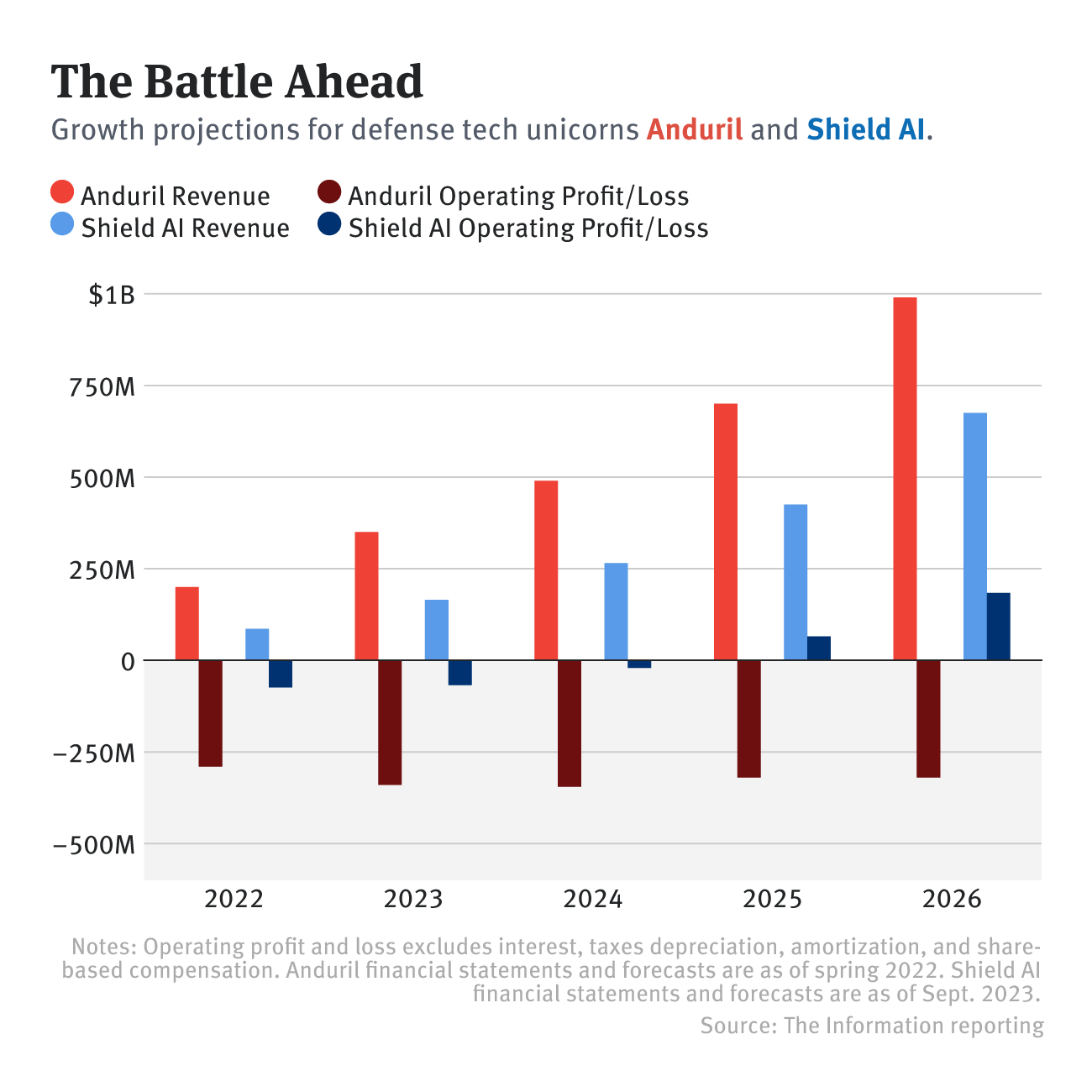

Left to right: Palmer Luckey, co-founder of Anduril; Ryan and Brandon Tseng, co-founders of Shield AI. Photos via Getty, Shield AI and Anduril.Anduril, the defense tech startup that says it’s trying to build the “Lockheed Martin of the 21st century,” laid out lofty goals to investors early last year. It set its sights on $1 billion in annual revenue by 2026, five times its expectation for $200 million of revenue in 2022.

Achieving that ambition will be expensive. The six-year-old startup, valued last year at $8.5 billion by Founders Fund and others, told investors it expected to burn a total of $2 billion in cash between 2021 and 2026. And it expected to incur hundreds of millions of dollars in net losses each of those years as it develops and sells drones, missiles, submarines and border protection systems to U.S. agencies and allied governments.

The Takeaway

- Anduril targeted nearly $1 billion in revenue by 2026, $2 billion of cash burn from 2021 to 2026

- Shield AI expects 2023 revenue of about $165 million, up more than 90% from 2022

- Sequoia led $6 million investment in defense parts maker Senra Systems this year

Powered by Deep Research

Anduril is trying to reward investors’ faith with growth. In recent months, Anduril told investors it is on track to book $625 million in new government contracts this year, on an average annual basis, which would be more than triple what it generated two years ago, a person familiar with the matter said. Shield AI, an Andreessen Horowitz–backed developer of autonomous defense systems, is another defense tech firm that is growing quickly: Last month it told investors it expected revenue to grow more than 90% this year to about $165 million, even as it racks up significant losses, according to financial forecasts viewed by The Information.

Anduril’s and Shield AI’s financial forecasts and recent results, which haven’t previously been reported, explain why more venture capitalists have started to invest in defense technology startups—and why many have stayed away. Demand for high-tech defense systems is rising, thanks to increases in the U.S. defense budget and the outbreak of wars such as those in Ukraine and now Israel. Plus, SpaceX and Palantir have shown VC-backed firms can break into a sector long dominated by older government contractors.

For some investors, those factors are overshadowing the reasons many VC firms have avoided investing, including the high, multiyear cost of developing sophisticated defense systems and long timelines of winning contracts that can cloud financial forecasts.

With defense tech startups, “there has been nervousness in the venture community about the ability to successfully go to market with products into the government,” said Ross Fubini, managing partner at early-stage venture firm XYZ Venture Capital, an early investor in Anduril. “What all of these companies are showing is that there are paths to do that.”

Sequoia Capital this year joined Andreessen Horowitz and General Catalyst in investing in the sector. The firm led a $6 million investment in military parts manufacturer Senra Systems, which hasn’t been previously reported, a person with direct knowledge of the matter said. Sequoia also made a $5.7 million investment for hydrogen-powered military hardware maker Mach Industries. Partner Shaun Maguire, who has previously led AI and crypto deals, among other sectors, and was deployed in Afghanistan while working for the Department of Defense, is leading Sequoia’s foray into defense, according to people with direct knowledge of the matter.

The mini-boom in defense tech venture capital funding began in 2021, the year after Anduril surpassed a $1 billion valuation. In 2021, firms poured more than $40 billion across more than 900 deals for such firms, more than they had invested in the previous two years combined, according to PitchBook. The number and value of deals slumped slightly last year, as venture capital funding dried up overall. But likely new funding rounds from Shield AI and Anduril this year should lift this year’s numbers.

Many VC firms are still grappling with limited partner agreements that bar them from investing in weaponry. And some investors in VC funds may not want to back startups that develop weapons for ethical reasons.

‘Abyss of Doom’

Defense tech startups may also test investors’ appetite for big losses in an era of Silicon Valley belt-tightening. Shield AI, an 8-year-old startup building software systems that serve as AI pilots to fly vehicles such as drones and fighter jets autonomously, has told investors in recent months it expects to lose nearly $70 million this year, excluding some expenses like interest, taxes and share-based compensation, according to financial statements and forecasts viewed by The Information.

“Defense tech is a very hard place to operate. I have to tell investors, ‘I have stared into the abyss of doom, death and despair many, many times,’” said Brandon Tseng, Shield’s co-founder and president. The startup, last valued at $2.3 billion, has been seeking to raise hundreds of millions in new cash in recent months.

Tseng said the company expected to turn a profit by 2025 when measured before interest, taxes, depreciation and amortization. “We’re executing the plan to get there just because we believe there has been a fundamental shift in how the markets think about these businesses,” Tseng said, referring to a focus on profits.

Anduril’s road hasn’t been smooth, either. It missed its annual contract goals by about 11% in 2021, the company told investors. One of the multimillion-dollar contracts it won in 2021, which came from the military operations unit of the United Arab Emirates, finally got done after months of negotiations. “To say this was a slog would be an understatement,” the company wrote in a regular update to investors that year.

“The vagaries of contracting timelines, bureaucratic snafus and government budgets are part and parcel of the industry we have entered, so we expect to get it wrong some of the time,” the company wrote in another update to investors last year.

The Costa Mesa, Calif.–based startup won big deals in 2022 from the U.S. Department of Defense to counter drone threats and with the Australian Navy to build autonomous submarines.

Last year it booked about $450 million of new government contracts by average annual value, according to an investor document. That beat an internal goal for the year by about 29%. Now, the company expects to surpass the financial targets it gave investors last year, a person familiar with the company said.

Existing investors have sought to grab bigger stakes in Anduril, jostling to put more money into the firm that would help it pay for more acquisitions, according to people familiar with the matter. The company has been in talks to raise $400 million to $500 million in a convertible note that would essentially value the company at $10 billion, Bloomberg reported. Founders Fund is by far the largest outside backer of Anduril, owning nearly 20% of the startup, a person familiar with the matter said.

One of Anduril’s earliest backers, Lux Capital, is now “underwriting with high confidence” that the company’s value will reach at least $20 billion in the coming years, “with the potential to be multiples of that,” Josh Wolfe, a Lux co-founder and managing partner, said.

Still, investors are valuing Anduril many multiples higher than traditional defense contractors, at more than 12 times its expected 2025 revenue. Raytheon, Northrop Grumman and General Dynamics—which are all profitable and growing more slowly than Anduril—are valued between 1.2 and 1.7 times forecast 2025 revenue.

Palmer Luckey, who founded Anduril after selling virtual reality firm Oculus to Meta, told online publication Breaking Defense that the company was better suited to taking money from venture investors than from public shareholders.

“Wall Street would look at our company and say, ‘This is still a very high-risk venture they have; they’re making these large investments in programs that may or may not pan out,’” he said, adding that Anduril was trying to change that perception.

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.

Natasha Mascarenhas is a reporter at The Information, based in San Francisco, who covers venture capital and startups. She can be reached at [email protected], or on Signal at +1 925 271 0912. She is on Twitter at @nmasc_

Kate Clark is a deputy bureau chief at The Information and the author of the twice-weekly column, Dealmaker. She is based in New York and can be found on Twitter at @KateClarkTweets. You can reach her via Signal at +1 (415)-409-9095.